Do you want to impress investors with your pitch deck? Make it short! The longer the deck, the weaker and less focused you seem to the VCs. The good thing? All you need are those 8 slides to land you a sweet pre-seed round💰.

Borys Musielak

I invest in early stage startups in CEE via SMOK.vc.

Yes, even in this market🐻.

Slide 1. COMPANY NAME + LOGO + High Level pitch (one sentence)

Tell me what you do without the use of adjectives / syntactic sugar🍬

The shorter the better. The simpler the better.

Make it simple enough even a VC will understand!

Slide 2. TEAM 🧔👩🧑🏿

Yes, it’s a bit radical to start with team slide, but that’s what makes pre-seed VCs excited.

All you need to do here is:

– state the biggest achievement 🏆 of each of the founder

– show that you know the industry💡you’re trying to disrupt

– smile ☺️

Slide 3. PROBLEM

Tell me about your industry, assuming I know nothing about it (I probably don’t).

What’s its biggest problem? What impact does it have on business?

Slide 4. SOLUTION

Don’t repeat yourself here, I already know what problem you’re solving (see slide 3).

This is space for you to explain your unfair competitive advantage ⚔️ in your industry.

What have you figured out that others haven’t?

How is this defensible? 🛡️

Slide 5. WHY NOW?

Why hasn’t this been solved, yet?

Has there been a recent break through in research🔬 / tech 👩💻 / data availability 💾 / regulation 🗳️ that makes the previously impossible possible?

Timing 🕜 is everything in business. Show me time is on your side!

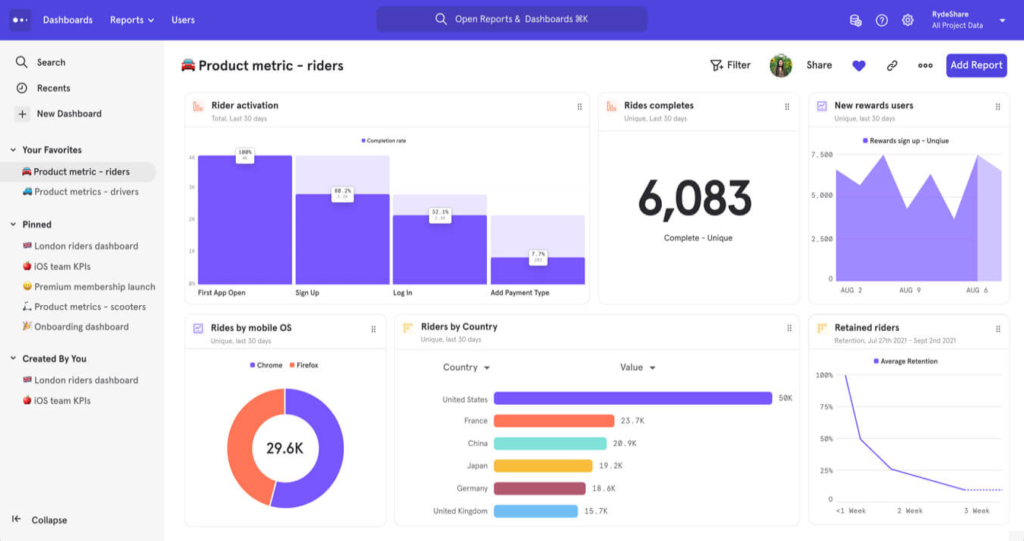

Slide 6. TRACTION 📈

This is the most important slide outside of the TEAM slide.

How many customers have you talked to?

How many bought your product?

Do you have any sales (actual or booked)?

I need to feel your urgency! I need to believe all you care about is this company.

Slide 7. MARKET

The purpose of this slide is to convince me that the opportunity is big enough.

Good founders can show that even with the initial product this can be a unicorn 🦄

The best founders show the vision that is even bigger 🦄🦄🦄 and it’s backed by the numbers📊.

Slide 8. THE ASK

How much are you raising? 💸

How much runway will it give you? 🛫

What are you going to achieve by then? 🛬

I need to understand you have a plan📝.

Plans can change, but you gotta have one.

***

At SMOK Ventures we invest in top pre-seed founders in the CEE region.

🇵🇱🇨🇿 🇸🇰🇪🇪🇱🇹🇱🇻🇺🇦🇧🇾🇷🇴 🇧🇬 🇭🇺🇸🇮🇭🇷🇲🇰🇷🇸🇲🇪🇧🇦🇲🇩🇦🇱🇽🇰🇦🇲🇬🇪🇦🇿🇰🇿

If you like what you read, take a look at our FAQ https://www.smok.vc/faq/ and reach out at borys@smok.vc